The impact of FinTech innovations on life insurance in India: what retailers should know

The FinTech revolution has transformed the global sphere, and the life insurance sector in India is no exception.

As a retailer (agent/broker) in this rapidly changing sphere, you must know how FinTech transforms life insurance in India. Innovations in digital tools, data analytics, and AI create opportunities for insurers, customers, and businesses, making it an exciting time to understand these trends and leverage them to your advantage.

Streamlined Customer Experience

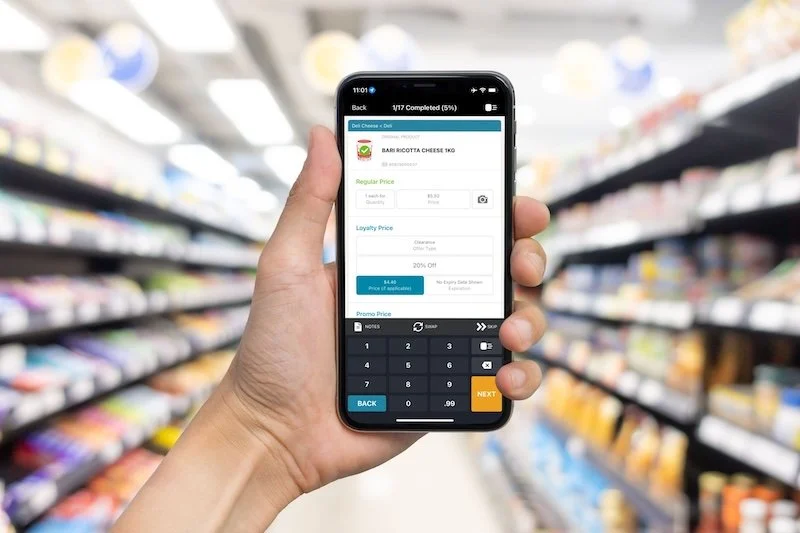

Due to FinTech, how consumers interact with life insurance providers in India is dramatically changing. Buying a life insurance policy used to be laborious, full of paperwork, and tedious, demanding considerable time and effort. Thanks to FinTech innovations, however, consumers can now make insurance purchases through digital platforms in minutes. Retailers can benefit from these advancements by partnering with insurers that offer a seamless, end-to-end digital solution.

Online portals, mobile apps, and chatbots make research, comparison, and buying decisions much easier for prospective clients without stepping into a physical store or meeting agents in person. Therefore, you can reach a much wider audience without the geographical constraints typical of a bricks and mortar establishment.

E-signatures, digital documents, and online payment systems will smooth out the insurance purchase process, thus making it much easier. With these tools in hand, retailers could provide customers with a seamless journey towards purchase, ultimately converting more and increasing customer satisfaction.

Personalised Insurance Products

Personalisation can be most favourably viewed when comparing the insurance industry and fintech applications. Life insurers now use advances in Big Data analytics, machine learning, and artificial intelligence (AI) to collate, analyse, and interpret tremendous volumes of information for product personalisation based on a client's individual characteristics, lifestyle, and financial standing.

FinTech tools enable insurers to develop sophisticated algorithms that create personalised policies based on health, age, income, and risk appetite. Customers now have a better chance of finding a product that fits their needs, and as a result, they are more inclined to make such purchases.

Some of those insights also help you better understand your customers so that you can make proper product recommendations. Data embedded tools, such as predictive analytics and AI driven insights, allow you to anticipate customers' needs, and consequently, there are more chances to close the insurance sale.

Cost Reduction and Affordability

FinTech innovations have made life insurance companies significantly less expensive to operate. Traditional insurers faced numerous high costs associated with reporting paperwork, inefficient manual processes, and the operation of physical infrastructures. With the emergence of digital solutions in wide use today, some of those costs have been eliminated or significantly reduced.

In this context, customers may receive policies at more competitive rates, which is a game-changer for India, where affordability remains a key concern for a large segment of the population. Such information on cost-saving innovations will position retailers well for selling affordable and enticing life insurance products.

Improved Risk Assessment and Underwriting

FinTech solutions allow for new, more accurate data collection and analysis techniques, producing a better risk assessment in life insurance. In older underwriting, manual assessments had a larger role in the entire process. With artificial intelligence and machine learning, insurers will assess a customer's risk profile faster.

AI improves predictive accuracy by analysing medical data, lifestyle habits, and other risk factors. It also shortens the approval process duration and generates pricing decisions that are fair and precise for customers. However, human oversight remains essential for complex cases requiring deeper evaluation.

Conclusion

FinTech innovation is driving change in the Indian life insurance sector, and retailers must stay attentive to emerging trends. By embracing digital tools, they can create better customer experiences, outpace the competition, and offer greater value to their clients.

Continue reading…